Weekly Market Update

Horrendous week for crypto and equity markets alike. US stocks recorded their worst weekly performance since the pandemic as worries of a QT induced recession rippled through global markets; Crypto market in full capitulation mode as investors digest the impact of macro, Celsius and 3AC’s fallout. BTC’s psychological stronghold at $20k has been breached and ETH defi continues to see dramatic deleveraging. Multiple signals point towards the same conclusion: The bottom is not in yet…

This Week in Defi

What’s the point of a hedge fund that doesn’t hedge? The situation of 3AC really took a lot of people by surprise. With the fallout of Celsius/3AC and a challenging macro backdrop, the space has entered an unprecedented deleveraging phase. Defi TVL fell by $120b in just a few weeks.

Three digit ETH is really painful to see, can the devs do something?

Three Arrow Capital

The whole situation seems quite surreal… a well established crypto HF/VC with peak AUM of almost 18 yards have been recklessly borrowing unsecured loans from multiple lenders and ghosted everyone when they got margin calls. Apart from using high leverage without proper risk management, rumor says they also offer these shady structured credit products to yield seekers who are looking for 10-15% yield (How many protocols parked their treasury with 3ac and can’t redeem?).

We still don’t have a full grasp of the impact yet but more dominos will likely fall as they literally borrowed from everyone.

Collated some good threads on the 3ac situation:

And you know it is REALLY bad when you see this:

CeFi troubles

Celsius: still solvent on chain. Has been paying back debt on Maker & Aave. No updates on their current financial situation and they even canceled their planned youtube livestream yesterday 5 mins before start time.

Babel Finance, Hong Kong-based crypto lender has suspended withdrawals and redemptions, according to an announcement on the company's website. The 2 billion lender does business mostly with miners. As BTC price falls, miners are having a hard time maintaining their profitability (more on this later), further diminishing Babel’s interest margins.

With Coinbase slashing 20% workforce and Blockfi taking heavy haircuts in raises, the current situation is worrisome to say the least for Cefi companies. Have a feeling we are barely scratching the surface of what’s yet to come.

BTC Miners - neglected dumpoors?

BTC is down 70% from all time highs. 7-day avg hashrate has fallen 9% to 212 EH/s since hitting an all-time high of 234 EH/s on June 12.

With energy costs rising and BTC price falling, hashrate is growing much more slowly this year than most folks anticipated.

In the current environment, It is tough to say how much of the sell pressure is coming from miners but the below graphs paint a broad picture of the increasing miner dump.

The Difficulty Ribbon is compressed, signaling miner stress and potential capitulation on the horizon.

On Chain Analytics

Whale liquidations

Celsius remains solvent onchain. Its wallets have seen debt repayments and a reduction of liquidation price; wBTC Maker vault ($460m collateral) now has a liquidation price at $13.6k, relatively safer. The Aave vault($540m collateral) now has a health ratio of 1.44.

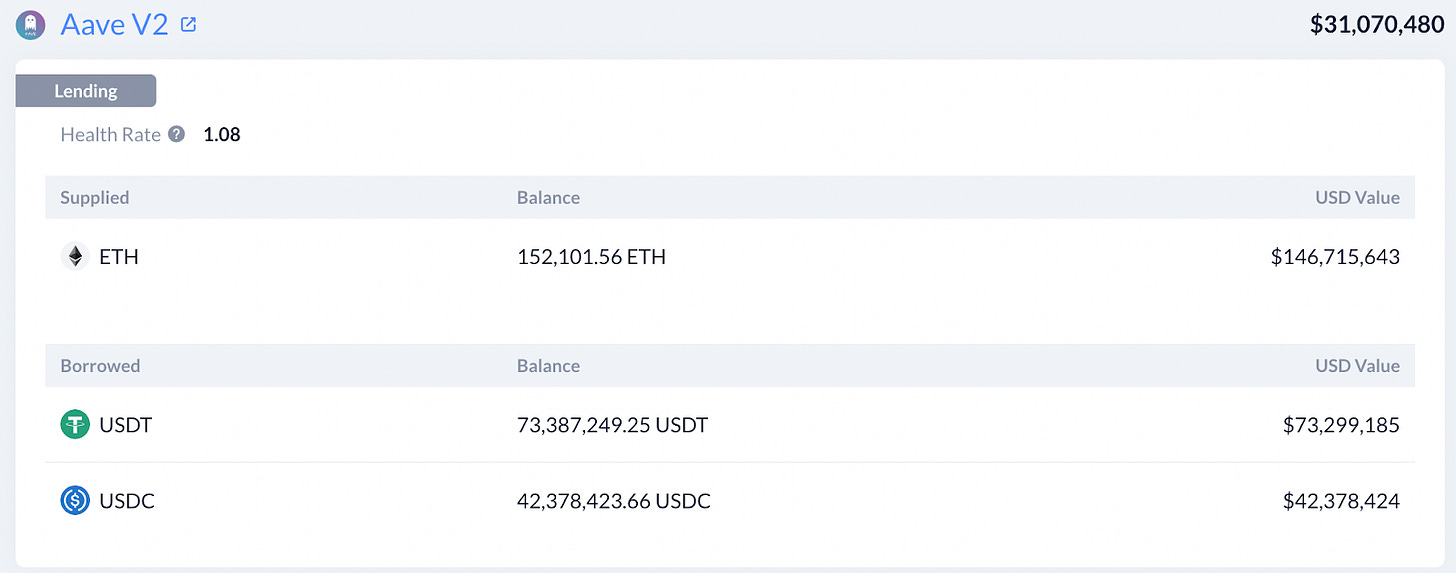

The Aave whale(rumored to be Meitu CEO) unwound part of his position from 212k ETH to 152k ETH after almost being liquidated when health ratio hits 1.0 earlier this week. It is now sitting at 1.08. Not quite safe as liquidation price currently sits at $889.

Liquidation is likely to start if there is another leg lower. ETH currently trading at $962

Solend whale mega position with $167m SOL deposited and $108m stables borrowed; This guy is currently 95% of the SOL deposits and 86% of USDC borrows on the largest money money protocol on Solana chain.

Liquidation price at $22, still got a lot of room but worth the attention given the overall tight liquidity situation onchain. Bot liquidators could easily push down the onchain prices of SOL when they swap SOL for USDC on the DEXes. Two of the largest DEXes showing limited liquidity for SOL-USDC pair.

Orca:

Raydium:

Once liquidation level was triggered, this could potentially lead to a cascading liquidation event that can nuke SOL price further down.

stETH

The discount widened, trading at 0.937 now. Stories of 3AC using stETH as collateral to borrow was one of main reasons for the further deviation. Liquidity was particularly bad as money was constantly being pulled out of Curve, causing extreme trading volatility of the stETH/ETH pair.

The pool itself continues to be heavily skewed towards stETH. Expect to see further deviation of the pair given there is less and less ETH to absorb the selling. Only 117k ETH remained in the pool.

However, the speed at which LPs are withdrawing ETH from the pool is slowing down per the below data pulled from Dune. Number of withdrawals is also in decline mode. Depending on the 3AC/Celsius situation, we can look to long some stETH at the right timing.

The actual situation is for sure 100x worse than what’s publicly known now. Defi is in a tough spot now as excessive leverage built up over the past few years is being washed out. I was not really around during the 2018 crash so I don’t have any credibility to compare but most will prob agree with me that this round of deleveraging is swifter and more aggressive than the previous ones. GL out there to everyone and hope we can survive.

TL DR: Don’t fight the feddddd

Sources from the Internet, Twitter, Parsec, Dune Analytics, NFA.

Consider donating to 0x1860CA387F185480b1b8A02a3D04b539aD13b16A

https://twitter.com/lilwhaley8888